Munich-chain-ladder Model

MunichChainLadder.RdThe Munich-chain-ladder model forecasts ultimate claims based on a cumulative

paid and incurred claims triangle.

The model assumes that the Mack-chain-ladder model is applicable

to the paid and incurred claims triangle, see MackChainLadder.

Usage

MunichChainLadder(Paid, Incurred,

est.sigmaP = "log-linear", est.sigmaI = "log-linear",

tailP=FALSE, tailI=FALSE, weights=1)Arguments

- Paid

cumulative paid claims triangle. Assume columns are the development period, use transpose otherwise. A (mxn)-matrix \(P_{ik}\) which is filled for \(k \leq n+1-i; i=1,\ldots,m; m\geq n\)

- Incurred

cumulative incurred claims triangle. Assume columns are the development period, use transpose otherwise. A (mxn)-matrix \(I_{ik}\) which is filled for \(k \leq n+1-i; i=1,\ldots,m, m\geq n \)

- est.sigmaP

defines how \(sigma_{n-1}\) for the Paid triangle is estimated, see

est.sigmainMackChainLadderfor more details, asest.sigmaPgets passed on toMackChainLadder- est.sigmaI

defines how \(sigma_{n-1}\) for the Incurred triangle is estimated, see

est.sigmainMackChainLadderfor more details, asest.sigmaIis passed on toMackChainLadder- tailP

defines how the tail of the

Paidtriangle is estimated and is passed on toMackChainLadder, seetailjust there.- tailI

defines how the tail of the

Incurredtriangle is estimated and is passed on toMackChainLadder, seetailjust there.- weights

weights. Default: 1, which sets the weights for all triangle entries to 1. Otherwise specify weights as a matrix of the same dimension as Triangle with all weight entries in [0; 1]. Hence, any entry set to 0 or NA eliminates that age-to-age factor from inclusion in the model. See also 'Details' in MackChainladder function. The weight matrix is the same for Paid and Incurred.

Value

MunichChainLadder returns a list with the following elements

- call

matched call

- Paid

input paid triangle

- Incurred

input incurred triangle

- MCLPaid

Munich-chain-ladder forecasted full triangle on paid data

- MCLIncurred

Munich-chain-ladder forecasted full triangle on incurred data

- MackPaid

Mack-chain-ladder output of the paid triangle

- MackIncurred

Mack-chain-ladder output of the incurred triangle

- PaidResiduals

paid residuals

- IncurredResiduals

incurred residuals

- QResiduals

paid/incurred residuals

- QinverseResiduals

incurred/paid residuals

- lambdaP

dependency coefficient between paid chain-ladder age-to-age factors and incurred/paid age-to-age factors

- lambdaI

dependency coefficient between incurred chain-ladder ratios and paid/incurred ratios

- qinverse.f

chain-ladder-link age-to-age factors of the incurred/paid triangle

- rhoP.sigma

estimated conditional deviation around the paid/incurred age-to-age factors

- q.f

chain-ladder age-to-age factors of the paid/incurred triangle

- rhoI.sigma

estimated conditional deviation around the incurred/paid age-to-age factors

Author

Markus Gesmann markus.gesmann@gmail.com

Examples

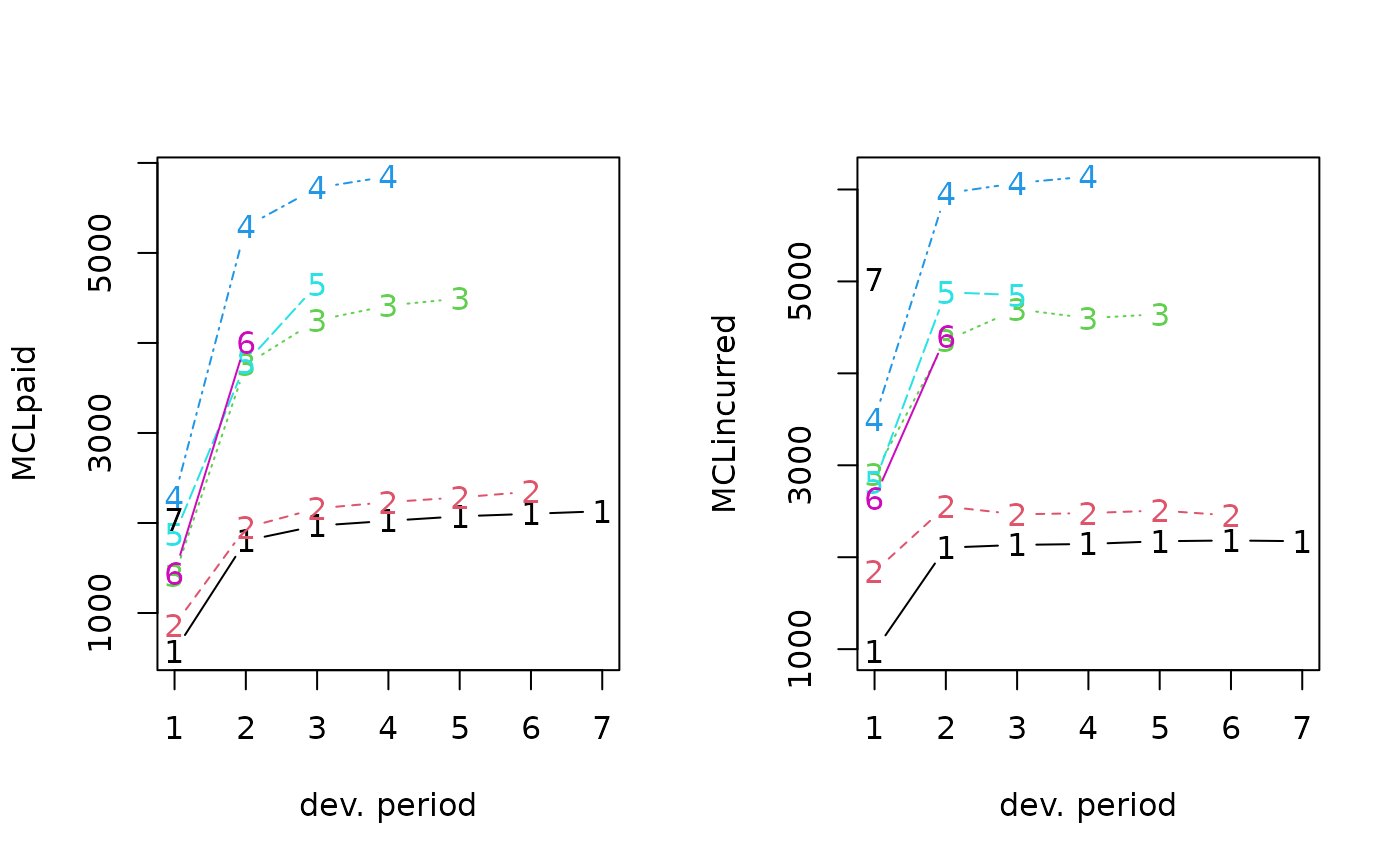

MCLpaid

#> dev

#> origin 1 2 3 4 5 6 7

#> 1 576 1804 1970 2024 2074 2102 2131

#> 2 866 1948 2162 2232 2284 2348 NA

#> 3 1412 3758 4252 4416 4494 NA NA

#> 4 2286 5292 5724 5850 NA NA NA

#> 5 1868 3778 4648 NA NA NA NA

#> 6 1442 4010 NA NA NA NA NA

#> 7 2044 NA NA NA NA NA NA

MCLincurred

#> dev

#> origin 1 2 3 4 5 6 7

#> 1 978 2104 2134 2144 2174 2182 2174

#> 2 1844 2552 2466 2480 2508 2454 NA

#> 3 2904 4354 4698 4600 4644 NA NA

#> 4 3502 5958 6070 6142 NA NA NA

#> 5 2812 4882 4852 NA NA NA NA

#> 6 2642 4406 NA NA NA NA NA

#> 7 5022 NA NA NA NA NA NA

op <- par(mfrow=c(1,2))

plot(MCLpaid)

plot(MCLincurred)

par(op)

# Following the example in Quarg's (2004) paper:

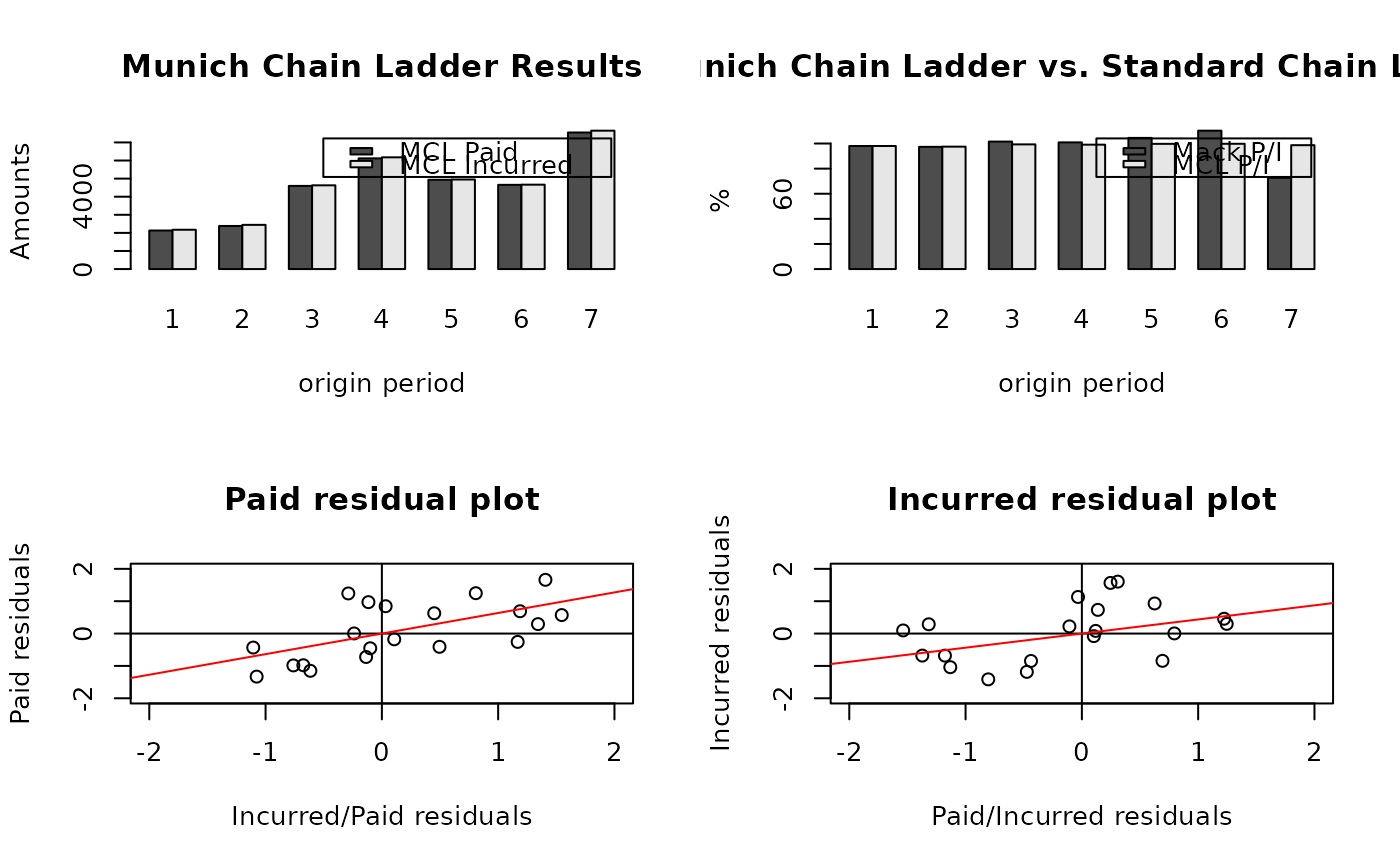

MCL <- MunichChainLadder(MCLpaid, MCLincurred, est.sigmaP=0.1, est.sigmaI=0.1)

MCL

#> MunichChainLadder(Paid = MCLpaid, Incurred = MCLincurred, est.sigmaP = 0.1,

#> est.sigmaI = 0.1)

#>

#> Latest Paid Latest Incurred Latest P/I Ratio Ult. Paid Ult. Incurred

#> 1 2,131 2,174 0.980 2,131 2,174

#> 2 2,348 2,454 0.957 2,383 2,444

#> 3 4,494 4,644 0.968 4,597 4,629

#> 4 5,850 6,142 0.952 6,119 6,176

#> 5 4,648 4,852 0.958 4,937 4,950

#> 6 4,010 4,406 0.910 4,656 4,665

#> 7 2,044 5,022 0.407 7,549 7,650

#> Ult. P/I Ratio

#> 1 0.980

#> 2 0.975

#> 3 0.993

#> 4 0.991

#> 5 0.997

#> 6 0.998

#> 7 0.987

#>

#> Totals

#> Paid Incurred P/I Ratio

#> Latest: 25,525 29,694 0.86

#> Ultimate: 32,371 32,688 0.99

plot(MCL)

par(op)

# Following the example in Quarg's (2004) paper:

MCL <- MunichChainLadder(MCLpaid, MCLincurred, est.sigmaP=0.1, est.sigmaI=0.1)

MCL

#> MunichChainLadder(Paid = MCLpaid, Incurred = MCLincurred, est.sigmaP = 0.1,

#> est.sigmaI = 0.1)

#>

#> Latest Paid Latest Incurred Latest P/I Ratio Ult. Paid Ult. Incurred

#> 1 2,131 2,174 0.980 2,131 2,174

#> 2 2,348 2,454 0.957 2,383 2,444

#> 3 4,494 4,644 0.968 4,597 4,629

#> 4 5,850 6,142 0.952 6,119 6,176

#> 5 4,648 4,852 0.958 4,937 4,950

#> 6 4,010 4,406 0.910 4,656 4,665

#> 7 2,044 5,022 0.407 7,549 7,650

#> Ult. P/I Ratio

#> 1 0.980

#> 2 0.975

#> 3 0.993

#> 4 0.991

#> 5 0.997

#> 6 0.998

#> 7 0.987

#>

#> Totals

#> Paid Incurred P/I Ratio

#> Latest: 25,525 29,694 0.86

#> Ultimate: 32,371 32,688 0.99

plot(MCL)

# You can access the standard chain-ladder (Mack) output via

MCL$MackPaid

#> MackChainLadder(Triangle = Paid, weights = weights, est.sigma = est.sigmaP,

#> tail = tailP)

#>

#> Latest Dev.To.Date Ultimate IBNR Mack.S.E CV(IBNR)

#> 1 2,131 1.000 2,131 0.0 0.00 NaN

#> 2 2,348 0.986 2,380 32.4 7.05 0.218

#> 3 4,494 0.966 4,652 158.2 47.92 0.303

#> 4 5,850 0.946 6,182 331.6 63.52 0.192

#> 5 4,648 0.919 5,056 407.6 67.54 0.166

#> 6 4,010 0.813 4,934 924.1 289.09 0.313

#> 7 2,044 0.334 6,128 4,084.3 897.13 0.220

#>

#> Totals

#> Latest: 25,525.00

#> Dev: 0.81

#> Ultimate: 31,463.21

#> IBNR: 5,938.21

#> Mack.S.E 987.23

#> CV(IBNR): 0.17

MCL$MackIncurred

#> MackChainLadder(Triangle = Incurred, weights = weights, est.sigma = est.sigmaI,

#> tail = tailI)

#>

#> Latest Dev.To.Date Ultimate IBNR Mack.S.E CV(IBNR)

#> 1 2,174 1.000 2,174 0.0 0.00 NaN

#> 2 2,454 1.004 2,445 -9.0 7.22 -0.803

#> 3 4,644 1.014 4,582 -62.5 83.30 -1.333

#> 4 6,142 1.003 6,126 -15.6 104.85 -6.705

#> 5 4,852 1.003 4,839 -13.0 118.50 -9.128

#> 6 4,406 0.984 4,476 70.1 217.45 3.101

#> 7 5,022 0.596 8,429 3,406.8 874.91 0.257

#>

#> Totals

#> Latest: 29,694.00

#> Dev: 0.90

#> Ultimate: 33,070.85

#> IBNR: 3,376.85

#> Mack.S.E 994.23

#> CV(IBNR): 0.29

# Input triangles section 3.3.1

MCL$Paid

#> dev

#> origin 1 2 3 4 5 6 7

#> 1 576 1804 1970 2024 2074 2102 2131

#> 2 866 1948 2162 2232 2284 2348 NA

#> 3 1412 3758 4252 4416 4494 NA NA

#> 4 2286 5292 5724 5850 NA NA NA

#> 5 1868 3778 4648 NA NA NA NA

#> 6 1442 4010 NA NA NA NA NA

#> 7 2044 NA NA NA NA NA NA

MCL$Incurred

#> dev

#> origin 1 2 3 4 5 6 7

#> 1 978 2104 2134 2144 2174 2182 2174

#> 2 1844 2552 2466 2480 2508 2454 NA

#> 3 2904 4354 4698 4600 4644 NA NA

#> 4 3502 5958 6070 6142 NA NA NA

#> 5 2812 4882 4852 NA NA NA NA

#> 6 2642 4406 NA NA NA NA NA

#> 7 5022 NA NA NA NA NA NA

# Parameters from section 3.3.2

# Standard chain-ladder age-to-age factors

MCL$MackPaid$f

#> [1] 2.436686 1.131242 1.029345 1.020756 1.021111 1.013796 1.000000

MCL$MackIncurred$f

#> [1] 1.6520910 1.0186398 0.9998699 1.0110581 0.9901751 0.9963336 1.0000000

MCL$MackPaid$sigma

#> [1] 13.4559310 3.6656420 0.4819578 0.2100029 0.4787308 0.1000000

MCL$MackIncurred$sigma

#> [1] 9.7273990 2.5444838 1.0040570 0.1200991 0.8603340 0.1000000

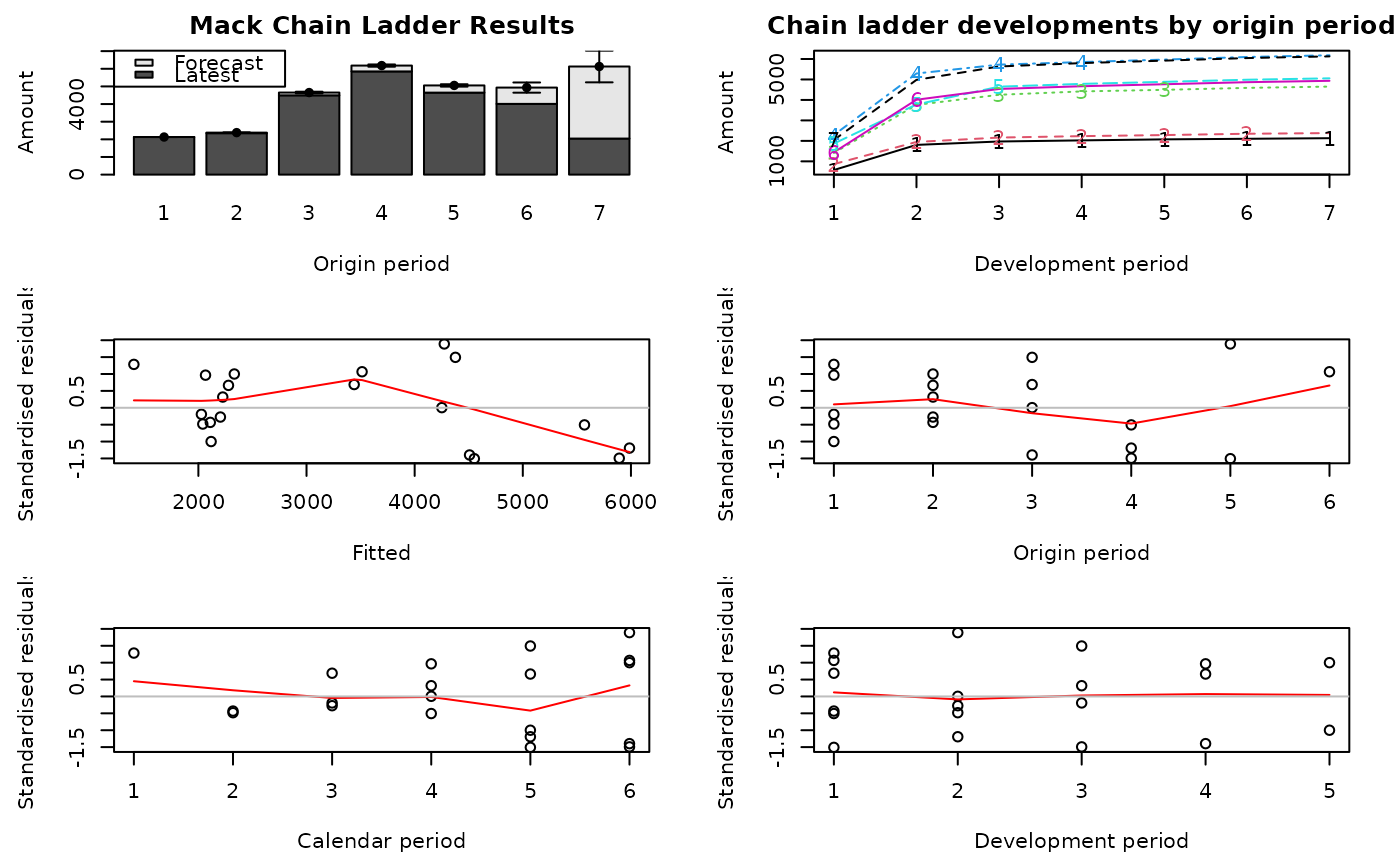

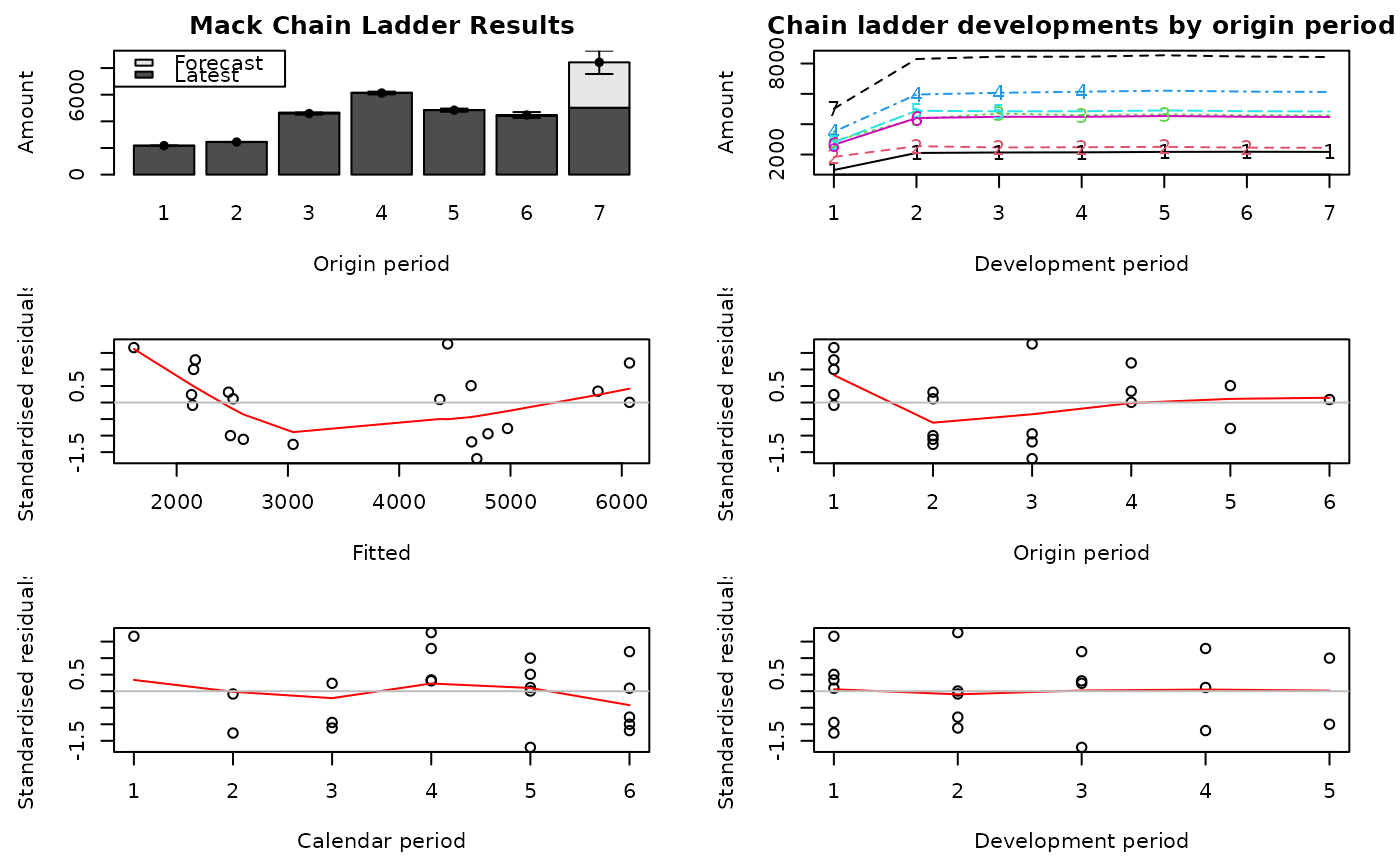

# Check Mack's assumptions graphically

plot(MCL$MackPaid)

# You can access the standard chain-ladder (Mack) output via

MCL$MackPaid

#> MackChainLadder(Triangle = Paid, weights = weights, est.sigma = est.sigmaP,

#> tail = tailP)

#>

#> Latest Dev.To.Date Ultimate IBNR Mack.S.E CV(IBNR)

#> 1 2,131 1.000 2,131 0.0 0.00 NaN

#> 2 2,348 0.986 2,380 32.4 7.05 0.218

#> 3 4,494 0.966 4,652 158.2 47.92 0.303

#> 4 5,850 0.946 6,182 331.6 63.52 0.192

#> 5 4,648 0.919 5,056 407.6 67.54 0.166

#> 6 4,010 0.813 4,934 924.1 289.09 0.313

#> 7 2,044 0.334 6,128 4,084.3 897.13 0.220

#>

#> Totals

#> Latest: 25,525.00

#> Dev: 0.81

#> Ultimate: 31,463.21

#> IBNR: 5,938.21

#> Mack.S.E 987.23

#> CV(IBNR): 0.17

MCL$MackIncurred

#> MackChainLadder(Triangle = Incurred, weights = weights, est.sigma = est.sigmaI,

#> tail = tailI)

#>

#> Latest Dev.To.Date Ultimate IBNR Mack.S.E CV(IBNR)

#> 1 2,174 1.000 2,174 0.0 0.00 NaN

#> 2 2,454 1.004 2,445 -9.0 7.22 -0.803

#> 3 4,644 1.014 4,582 -62.5 83.30 -1.333

#> 4 6,142 1.003 6,126 -15.6 104.85 -6.705

#> 5 4,852 1.003 4,839 -13.0 118.50 -9.128

#> 6 4,406 0.984 4,476 70.1 217.45 3.101

#> 7 5,022 0.596 8,429 3,406.8 874.91 0.257

#>

#> Totals

#> Latest: 29,694.00

#> Dev: 0.90

#> Ultimate: 33,070.85

#> IBNR: 3,376.85

#> Mack.S.E 994.23

#> CV(IBNR): 0.29

# Input triangles section 3.3.1

MCL$Paid

#> dev

#> origin 1 2 3 4 5 6 7

#> 1 576 1804 1970 2024 2074 2102 2131

#> 2 866 1948 2162 2232 2284 2348 NA

#> 3 1412 3758 4252 4416 4494 NA NA

#> 4 2286 5292 5724 5850 NA NA NA

#> 5 1868 3778 4648 NA NA NA NA

#> 6 1442 4010 NA NA NA NA NA

#> 7 2044 NA NA NA NA NA NA

MCL$Incurred

#> dev

#> origin 1 2 3 4 5 6 7

#> 1 978 2104 2134 2144 2174 2182 2174

#> 2 1844 2552 2466 2480 2508 2454 NA

#> 3 2904 4354 4698 4600 4644 NA NA

#> 4 3502 5958 6070 6142 NA NA NA

#> 5 2812 4882 4852 NA NA NA NA

#> 6 2642 4406 NA NA NA NA NA

#> 7 5022 NA NA NA NA NA NA

# Parameters from section 3.3.2

# Standard chain-ladder age-to-age factors

MCL$MackPaid$f

#> [1] 2.436686 1.131242 1.029345 1.020756 1.021111 1.013796 1.000000

MCL$MackIncurred$f

#> [1] 1.6520910 1.0186398 0.9998699 1.0110581 0.9901751 0.9963336 1.0000000

MCL$MackPaid$sigma

#> [1] 13.4559310 3.6656420 0.4819578 0.2100029 0.4787308 0.1000000

MCL$MackIncurred$sigma

#> [1] 9.7273990 2.5444838 1.0040570 0.1200991 0.8603340 0.1000000

# Check Mack's assumptions graphically

plot(MCL$MackPaid)

plot(MCL$MackIncurred)

plot(MCL$MackIncurred)

MCL$q.f

#> [1] 0.5325822 0.8488621 0.9275964 0.9450735 0.9491744 0.9598792 0.9802208

MCL$rhoP.sigma

#> [1] 14.9430129 4.9899464 2.1665565 1.6186098 1.7910011 0.2359799 0.1966189

MCL$rhoI.sigma

#> [1] 5.7107795 3.8192859 1.9184007 1.4606629 1.6370399 0.2219648 0.2494577

MCL$PaidResiduals

#> [1] 1.240062341 -0.409542454 0.627731906 -0.432520662 -1.330415661

#> [6] 0.971284236 NA -0.454493935 -0.257500458 0.003519297

#> [11] -0.984526495 1.660669736 NA NA -0.178096214

#> [16] 0.292551156 1.248117471 -1.151042283 NA NA

#> [21] NA 0.845586577 0.571652630 -0.978875177 NA

#> [26] NA NA NA -0.723943106 0.689859681

#> [31] NA NA NA NA NA

#> [36] NA NA NA NA NA

#> [41] NA NA NA NA NA

#> [46] NA NA NA NA

MCL$IncurredResiduals

#> [1] 1.605020358 -1.183723533 -0.846383581 0.299450714 0.458137992

#> [6] 0.082352480 NA -0.078980622 -1.039118036 1.565493903

#> [11] 0.004806834 -0.680589085 NA NA 0.221585430

#> [16] 0.287221014 -1.415119918 0.930505026 NA NA

#> [21] NA 1.131348046 0.096288253 -0.843077797 NA

#> [26] NA NA NA 0.731893789 -0.681418728

#> [31] NA NA NA NA NA

#> [36] NA NA NA NA NA

#> [41] NA NA NA NA NA

#> [46] NA NA NA NA

MCL$QinverseResiduals

#> [1] -0.28866099 0.49565517 0.45015637 -1.10614730 -1.07679458 -0.11554182

#> [7] NA -0.10001795 1.16766593 -0.23897922 -0.76095980 1.40633581

#> [13] NA NA 0.10639977 1.34252842 0.80771329 -0.61487164

#> [19] NA NA NA 0.03251491 1.54674415 -0.67544873

#> [25] NA NA NA NA -0.13556094 1.18814416

#> [31] NA NA NA NA NA NA

#> [37] NA NA NA NA NA NA

#> [43] NA NA NA NA NA NA

#> [49] NA

MCL$QResiduals

#> [1] 0.30871615 -0.47335565 -0.43743334 1.24543896 1.22304681 0.11895559

#> [7] NA 0.10271271 -1.13141939 0.24623239 0.79537557 -1.37205649

#> [13] NA NA -0.10709430 -1.31687503 -0.80498376 0.62550343

#> [19] NA NA NA -0.03308516 -1.53672981 0.69308386

#> [25] NA NA NA NA 0.13749654 -1.17743245

#> [31] NA NA NA NA NA NA

#> [37] NA NA NA NA NA NA

#> [43] NA NA NA NA NA NA

#> [49] NA

MCL$lambdaP

#>

#> Call:

#> lm(formula = PaidResiduals ~ QinverseResiduals + 0)

#>

#> Coefficients:

#> QinverseResiduals

#> 0.636

#>

MCL$lambdaI

#>

#> Call:

#> lm(formula = IncurredResiduals ~ QResiduals + 0)

#>

#> Coefficients:

#> QResiduals

#> 0.4362

#>

# Section 3.3.3 Results

MCL$MCLPaid

#> 1 2 3 4 5 6

#> 1 576 1804.00 1970.000 2024.000 2074.000 2102.000 2131.000

#> 2 866 1948.00 2162.000 2232.000 2284.000 2348.000 2382.512

#> 3 1412 3758.00 4252.000 4416.000 4494.000 4573.461 4597.066

#> 4 2286 5292.00 5724.000 5850.000 5967.465 6080.613 6119.269

#> 5 1868 3778.00 4648.000 4761.928 4848.086 4922.643 4937.412

#> 6 1442 4010.00 4387.718 4493.324 4573.894 4642.893 4655.543

#> 7 2044 5658.75 6944.326 7176.571 7329.680 7485.196 7548.518

MCL$MCLIncurred

#> 1 2 3 4 5 6

#> 1 978 2104.00 2134.000 2144.000 2174.000 2182.000 2174.000

#> 2 1844 2552.00 2466.000 2480.000 2508.000 2454.000 2443.520

#> 3 2904 4354.00 4698.000 4600.000 4644.000 4618.095 4628.803

#> 4 3502 5958.00 6070.000 6142.000 6211.546 6166.937 6175.985

#> 5 2812 4882.00 4852.000 4884.997 4944.225 4931.215 4950.330

#> 6 2642 4406.00 4566.563 4600.621 4656.710 4646.230 4665.171

#> 7 5022 7828.26 7687.543 7643.941 7726.764 7649.849 7649.759

MCL$q.f

#> [1] 0.5325822 0.8488621 0.9275964 0.9450735 0.9491744 0.9598792 0.9802208

MCL$rhoP.sigma

#> [1] 14.9430129 4.9899464 2.1665565 1.6186098 1.7910011 0.2359799 0.1966189

MCL$rhoI.sigma

#> [1] 5.7107795 3.8192859 1.9184007 1.4606629 1.6370399 0.2219648 0.2494577

MCL$PaidResiduals

#> [1] 1.240062341 -0.409542454 0.627731906 -0.432520662 -1.330415661

#> [6] 0.971284236 NA -0.454493935 -0.257500458 0.003519297

#> [11] -0.984526495 1.660669736 NA NA -0.178096214

#> [16] 0.292551156 1.248117471 -1.151042283 NA NA

#> [21] NA 0.845586577 0.571652630 -0.978875177 NA

#> [26] NA NA NA -0.723943106 0.689859681

#> [31] NA NA NA NA NA

#> [36] NA NA NA NA NA

#> [41] NA NA NA NA NA

#> [46] NA NA NA NA

MCL$IncurredResiduals

#> [1] 1.605020358 -1.183723533 -0.846383581 0.299450714 0.458137992

#> [6] 0.082352480 NA -0.078980622 -1.039118036 1.565493903

#> [11] 0.004806834 -0.680589085 NA NA 0.221585430

#> [16] 0.287221014 -1.415119918 0.930505026 NA NA

#> [21] NA 1.131348046 0.096288253 -0.843077797 NA

#> [26] NA NA NA 0.731893789 -0.681418728

#> [31] NA NA NA NA NA

#> [36] NA NA NA NA NA

#> [41] NA NA NA NA NA

#> [46] NA NA NA NA

MCL$QinverseResiduals

#> [1] -0.28866099 0.49565517 0.45015637 -1.10614730 -1.07679458 -0.11554182

#> [7] NA -0.10001795 1.16766593 -0.23897922 -0.76095980 1.40633581

#> [13] NA NA 0.10639977 1.34252842 0.80771329 -0.61487164

#> [19] NA NA NA 0.03251491 1.54674415 -0.67544873

#> [25] NA NA NA NA -0.13556094 1.18814416

#> [31] NA NA NA NA NA NA

#> [37] NA NA NA NA NA NA

#> [43] NA NA NA NA NA NA

#> [49] NA

MCL$QResiduals

#> [1] 0.30871615 -0.47335565 -0.43743334 1.24543896 1.22304681 0.11895559

#> [7] NA 0.10271271 -1.13141939 0.24623239 0.79537557 -1.37205649

#> [13] NA NA -0.10709430 -1.31687503 -0.80498376 0.62550343

#> [19] NA NA NA -0.03308516 -1.53672981 0.69308386

#> [25] NA NA NA NA 0.13749654 -1.17743245

#> [31] NA NA NA NA NA NA

#> [37] NA NA NA NA NA NA

#> [43] NA NA NA NA NA NA

#> [49] NA

MCL$lambdaP

#>

#> Call:

#> lm(formula = PaidResiduals ~ QinverseResiduals + 0)

#>

#> Coefficients:

#> QinverseResiduals

#> 0.636

#>

MCL$lambdaI

#>

#> Call:

#> lm(formula = IncurredResiduals ~ QResiduals + 0)

#>

#> Coefficients:

#> QResiduals

#> 0.4362

#>

# Section 3.3.3 Results

MCL$MCLPaid

#> 1 2 3 4 5 6

#> 1 576 1804.00 1970.000 2024.000 2074.000 2102.000 2131.000

#> 2 866 1948.00 2162.000 2232.000 2284.000 2348.000 2382.512

#> 3 1412 3758.00 4252.000 4416.000 4494.000 4573.461 4597.066

#> 4 2286 5292.00 5724.000 5850.000 5967.465 6080.613 6119.269

#> 5 1868 3778.00 4648.000 4761.928 4848.086 4922.643 4937.412

#> 6 1442 4010.00 4387.718 4493.324 4573.894 4642.893 4655.543

#> 7 2044 5658.75 6944.326 7176.571 7329.680 7485.196 7548.518

MCL$MCLIncurred

#> 1 2 3 4 5 6

#> 1 978 2104.00 2134.000 2144.000 2174.000 2182.000 2174.000

#> 2 1844 2552.00 2466.000 2480.000 2508.000 2454.000 2443.520

#> 3 2904 4354.00 4698.000 4600.000 4644.000 4618.095 4628.803

#> 4 3502 5958.00 6070.000 6142.000 6211.546 6166.937 6175.985

#> 5 2812 4882.00 4852.000 4884.997 4944.225 4931.215 4950.330

#> 6 2642 4406.00 4566.563 4600.621 4656.710 4646.230 4665.171

#> 7 5022 7828.26 7687.543 7643.941 7726.764 7649.849 7649.759