Quarterly run off triangle of accumulated claims data

qpaid.rdSample data to demonstrate how to work with triangles with a higher development period frequency than origin period frequency

Examples

dim(qpaid)

#> [1] 12 45

dim(qincurred)

#> [1] 12 45

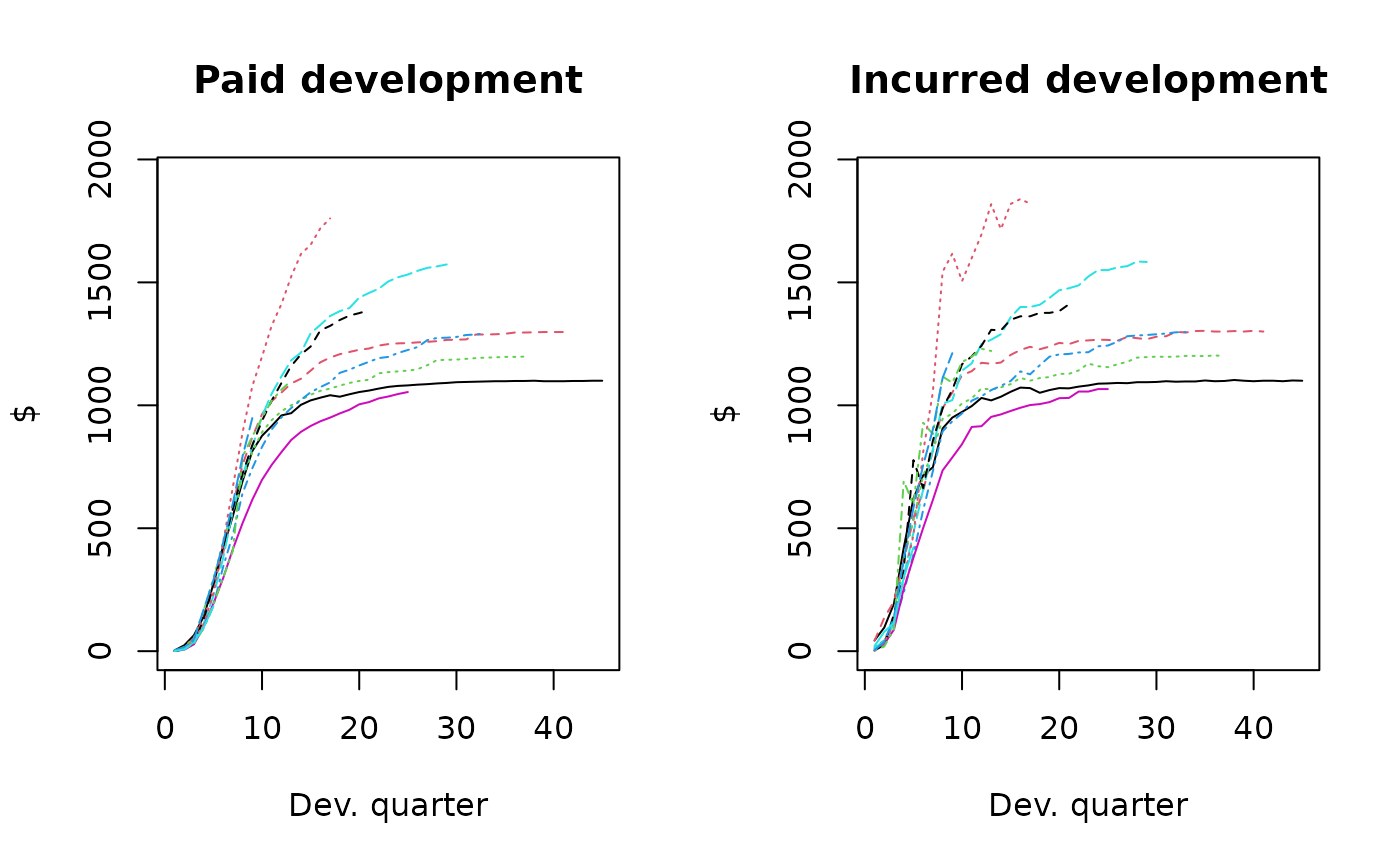

op=par(mfrow=c(1,2))

ymax <- max(c(qpaid,qincurred),na.rm=TRUE)*1.05

matplot(t(qpaid), type="l", main="Paid development",

xlab="Dev. quarter", ylab="$", ylim=c(0,ymax))

matplot(t(qincurred), type="l", main="Incurred development",

xlab="Dev. quarter", ylab="$", ylim=c(0,ymax))

par(op)

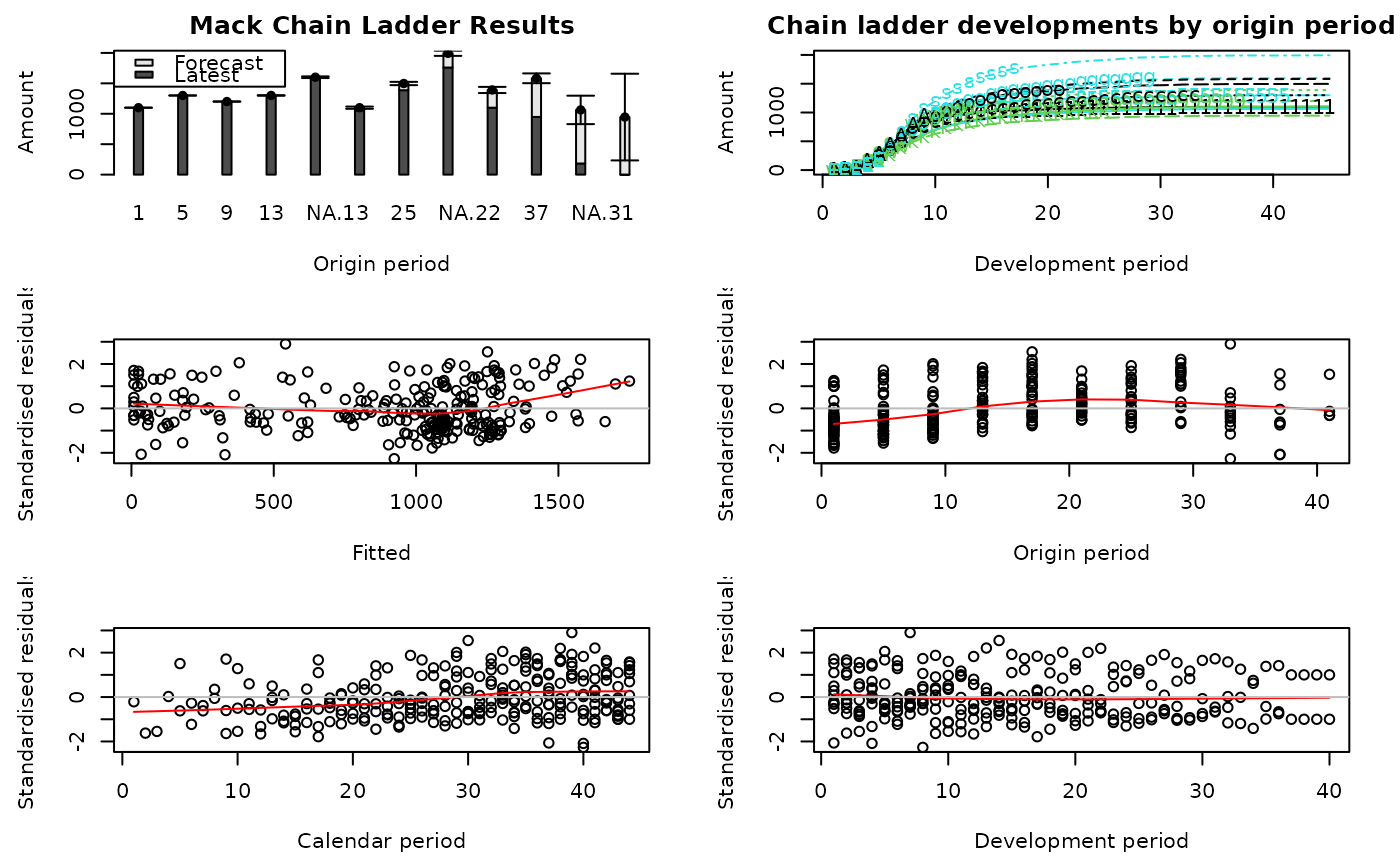

## MackChainLadder expects a quadratic matrix so let's expand

## the triangle to a quarterly origin period.

n <- ncol(qpaid)

Paid <- matrix(NA, n, n)

Paid[seq(1,n,4),] <- qpaid

M <- MackChainLadder(Paid)

#> Warning: Information: essentially no variation in development data for period(s):

#> '39-40', '40-41'

plot(M)

par(op)

## MackChainLadder expects a quadratic matrix so let's expand

## the triangle to a quarterly origin period.

n <- ncol(qpaid)

Paid <- matrix(NA, n, n)

Paid[seq(1,n,4),] <- qpaid

M <- MackChainLadder(Paid)

#> Warning: Information: essentially no variation in development data for period(s):

#> '39-40', '40-41'

plot(M)

# We expand the incurred triangle in the same way

Incurred <- matrix(NA, n, n)

Incurred[seq(1,n,4),] <- qincurred

# With the expanded triangles we can apply MunichChainLadder

MunichChainLadder(Paid, Incurred)

#> Warning: Information: essentially no variation in development data for period(s):

#> '39-40', '40-41'

#> MunichChainLadder(Paid = Paid, Incurred = Incurred)

#>

#> Latest Paid Latest Incurred Latest P/I Ratio Ult. Paid Ult. Incurred

#> 1 1,100 1,100 1.0000 1,100 1,100

#> 5 1,298 1,300 0.9985 1,300 1,300

#> 9 1,198 1,200 0.9983 1,201 1,201

#> 13 1,293 1,298 0.9961 1,301 1,301

#> 17 1,573 1,583 0.9937 1,601 1,601

#> 21 1,054 1,066 0.9887 1,100 1,100

#> 25 1,387 1,411 0.9830 1,498 1,498

#> 29 1,760 1,820 0.9670 1,995 1,995

#> 33 1,100 1,221 0.9009 1,398 1,397

#> 37 948 1,212 0.7822 1,590 1,590

#> 41 183 422 0.4336 1,086 1,086

#> 45 1 13 0.0769 1,073 1,073

#> Ult. P/I Ratio

#> 1 1

#> 5 1

#> 9 1

#> 13 1

#> 17 1

#> 21 1

#> 25 1

#> 29 1

#> 33 1

#> 37 1

#> 41 1

#> 45 1

#>

#> Totals

#> Paid Incurred P/I Ratio

#> Latest: 12,895 13,646 0.94

#> Ultimate: 16,243 16,242 1.00

# In the same way we can apply BootChainLadder

# We reduce the size of bootstrap replicates R

# from the default of 999 to 99 purely to reduce run time.

BootChainLadder(Paid, R=99)

#> BootChainLadder(Triangle = Paid, R = 99)

#>

#> Latest Mean Ultimate Mean IBNR IBNR.S.E IBNR 75% IBNR 95%

#> 1 1,100 1,100 0.00 0.00 0.00 0.0

#> 5 1,298 1,301 2.60 4.26 4.59 11.0

#> 9 1,198 1,201 2.59 4.54 5.10 10.9

#> 13 1,293 1,301 8.48 6.99 12.24 19.2

#> 17 1,573 1,602 28.67 11.12 35.09 46.0

#> 21 1,054 1,100 46.48 11.01 54.70 64.9

#> 25 1,387 1,495 107.95 18.83 119.96 138.5

#> 29 1,760 1,996 236.14 28.05 252.68 279.6

#> 33 1,100 1,392 292.37 33.20 312.90 348.2

#> 37 948 1,579 631.45 61.51 678.66 729.6

#> 41 183 1,049 866.08 165.54 950.38 1,159.0

#> 45 1 2,205 2,204.21 17,541.52 1,628.87 4,764.8

#>

#> Totals

#> Latest: 12,895

#> Mean Ultimate: 17,322

#> Mean IBNR: 4,427

#> IBNR.S.E 17,509

#> Total IBNR 75%: 3,997

#> Total IBNR 95%: 7,087

# We expand the incurred triangle in the same way

Incurred <- matrix(NA, n, n)

Incurred[seq(1,n,4),] <- qincurred

# With the expanded triangles we can apply MunichChainLadder

MunichChainLadder(Paid, Incurred)

#> Warning: Information: essentially no variation in development data for period(s):

#> '39-40', '40-41'

#> MunichChainLadder(Paid = Paid, Incurred = Incurred)

#>

#> Latest Paid Latest Incurred Latest P/I Ratio Ult. Paid Ult. Incurred

#> 1 1,100 1,100 1.0000 1,100 1,100

#> 5 1,298 1,300 0.9985 1,300 1,300

#> 9 1,198 1,200 0.9983 1,201 1,201

#> 13 1,293 1,298 0.9961 1,301 1,301

#> 17 1,573 1,583 0.9937 1,601 1,601

#> 21 1,054 1,066 0.9887 1,100 1,100

#> 25 1,387 1,411 0.9830 1,498 1,498

#> 29 1,760 1,820 0.9670 1,995 1,995

#> 33 1,100 1,221 0.9009 1,398 1,397

#> 37 948 1,212 0.7822 1,590 1,590

#> 41 183 422 0.4336 1,086 1,086

#> 45 1 13 0.0769 1,073 1,073

#> Ult. P/I Ratio

#> 1 1

#> 5 1

#> 9 1

#> 13 1

#> 17 1

#> 21 1

#> 25 1

#> 29 1

#> 33 1

#> 37 1

#> 41 1

#> 45 1

#>

#> Totals

#> Paid Incurred P/I Ratio

#> Latest: 12,895 13,646 0.94

#> Ultimate: 16,243 16,242 1.00

# In the same way we can apply BootChainLadder

# We reduce the size of bootstrap replicates R

# from the default of 999 to 99 purely to reduce run time.

BootChainLadder(Paid, R=99)

#> BootChainLadder(Triangle = Paid, R = 99)

#>

#> Latest Mean Ultimate Mean IBNR IBNR.S.E IBNR 75% IBNR 95%

#> 1 1,100 1,100 0.00 0.00 0.00 0.0

#> 5 1,298 1,301 2.60 4.26 4.59 11.0

#> 9 1,198 1,201 2.59 4.54 5.10 10.9

#> 13 1,293 1,301 8.48 6.99 12.24 19.2

#> 17 1,573 1,602 28.67 11.12 35.09 46.0

#> 21 1,054 1,100 46.48 11.01 54.70 64.9

#> 25 1,387 1,495 107.95 18.83 119.96 138.5

#> 29 1,760 1,996 236.14 28.05 252.68 279.6

#> 33 1,100 1,392 292.37 33.20 312.90 348.2

#> 37 948 1,579 631.45 61.51 678.66 729.6

#> 41 183 1,049 866.08 165.54 950.38 1,159.0

#> 45 1 2,205 2,204.21 17,541.52 1,628.87 4,764.8

#>

#> Totals

#> Latest: 12,895

#> Mean Ultimate: 17,322

#> Mean IBNR: 4,427

#> IBNR.S.E 17,509

#> Total IBNR 75%: 3,997

#> Total IBNR 95%: 7,087